Canada is home to several major financial institutions that dominate the banking landscape. These institutions have a significant market share, employ thousands of people, generate substantial revenue and profits, and offer a wide range of services.

A little bit of the history

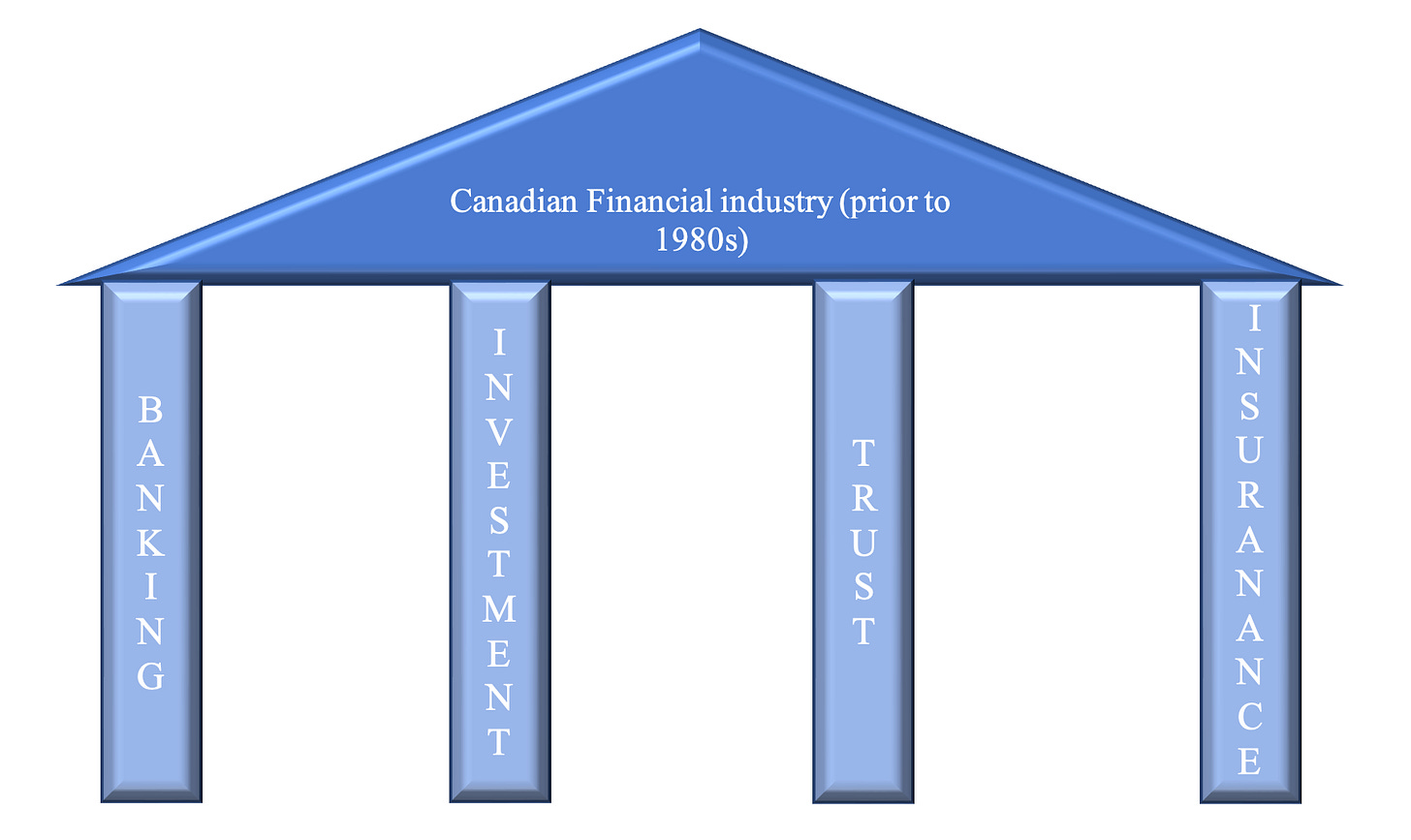

Prior to the 1980s, the financial industry was segregated and had 4 distinct pillars: Banks, Investment dealers, trust companies and life insurance companies.

Canadian Financial industry (prior to 1980s)

Banking

Banking is the cornerstone of the financial world, dating back centuries. It involves accepting deposits, lending money, and providing basic financial services like checking and savings accounts, loans, and mortgages. Think of it as the foundation upon which all other financial services are built.

Investment

Investment services focus on helping individuals and institutions grow their wealth through various investment vehicles like stocks, bonds, mutual funds, and more. Investment firms provide advice, research, and execution services to help clients make informed investment decisions and achieve their financial goals.

Trust

Trust services revolve around managing and safeguarding assets on behalf of clients. Trust companies act as fiduciaries, overseeing trusts, estates, and other assets to ensure they're managed and distributed according to clients' wishes. It's all about providing peace of mind and ensuring financial security for future generations.

Insurance

Insurance is all about managing risk and providing financial protection against unexpected events. Insurance companies offer policies that cover everything from life and health to property and casualty risks. By paying premiums, individuals and businesses transfer their risk to the insurance company, which steps in to provide financial assistance when needed.

The Big Gets Bigger: The Trend of Integration

In recent years, we've seen a trend toward integration in the financial industry, with big banks leading the way. In the 1980s and 1990s, Canada's largest banks acquired nearly all trust and brokerage companies, and they also launched their own insurance and mutual fund businesses. By combining banking, investment, trust, and insurance services under one roof, these institutions aim to provide holistic solutions to their clients' financial needs.

Understanding Financial Services: From Personal Banking to Capital Markets

Before we dive into the various services the big institutions provide, let’s get some terminologies out of the way. Some financial services the bank offers are straightforward, like personal banking, which you intuitively know it includes checking and savings accounts, credit cards, personal loans, and mortgages. However, other services might not be as familiar. Let's look at brief definitions of these lesser-known services.

What does Commercial Banking involve?

Commercial banking provides financial services to businesses, ranging from small local companies to large corporations. Services include business loans, lines of credit, commercial mortgages, and treasury management. For instance, a local grocery store might use a commercial banking service for a loan to expand its storefront.

What is Wealth Management really?

Wealth management combines financial planning, investment management, and other services to help high-net-worth individuals manage, preserve, and grow their wealth. This includes things like retirement planning, estate planning, and tax strategies. Remember, wealth management won't make you rich, at least not within a short period of time, but it will help you and your family stay rich!

The Three-Generation Curse of Wealth:

The first generation, the builder, accumulates wealth through hard work and determination.

The second generation, the maintainer, preserves the wealth.

But the third generation, the squanderer, often wastes it all away.

Wealth management aims to break that curse. It's about using tools and strategies to protect your hard-earned money from those spendthrift offspring so your wealth can go further down the line.

What is Private Banking? How is it different from regular banking?

You might have heard that billionaires like Elon Musk have a clever trick up their sleeves when it comes to accessing cash without selling their stocks. Instead of selling and getting hit with capital gains taxes, they borrow against the shares they own.

Here's how it works: Billionaires have excellent credit, so banks are more than happy to lend them money with very favorable interest rates. It's like taking a loan out on your house, but instead of a house, they use their Tesla or SpaceX shares as collateral. This way, they avoid selling their stocks and triggering capital gains taxes, all while keeping their cash flow fluid.

Think of it as a secret menu at an exclusive restaurant – only high-net-worth individuals get to enjoy these perks. It’s a classic private banking service designed to keep the wealthy, well, wealthy. Private banking services include:

Personalized Service: Private banking provides a dedicated private banker who understands your unique financial goals and needs. They can take care of most of your banking needs though phone calls or email requests, including making payments from accounts, issuing bank drafts, loan and mortgage applications, investment transactions. You barely need to step into a physical branch.

Customized lending: Private banking often provides tailored credit solutions, such as high limit mortgage, loans and lines of credit against investment portfolios and whole life insurance, often with lower interest rates and higher limits compared to regular banking, for people with more complicated borrowing needs.

In essence, private banking offers enhanced attention, expertise, and personalized financial management and lending. However, this customized service comes at a cost, typically ranging from $100 to $200 per month currently, varying among financial institutions. There are also usually loan origination fees involved with the customized lending. There may be fee rebates available based on factors like investable assets and specific profession, such as certain medical professionals can access private banking services for a lower fee. Like everything else, the actual delivery of claimed services hinges on the capabilities and professionalism of the individual private banker you work with. Referrals from trusted friends or professional networks can come in handy in finding the right person if you need this service.

What is Self-Directed Online Trading Platform

An online platform that allows investors to buy and sell securities on their own, without the assistance of a financial advisor. It generally charges a commission per trade. It is also known as discount brokerage. Platforms like Questrade where users can trade stocks, bonds, and ETFs directly. It's like shopping online, but for investments.

What is Robo-Advisor Platform?

A Robo-Advisor is a digital platform offering automated, algorithm-driven investment services with minimal human intervention. Typically, a Robo-advisor collects information about your financial situation and goals through an online survey. Using this data, it provides tailored advice and automatically manages your investments, making investing more accessible and hassle-free.

What is Full-Service Brokerage

As opposed to Discount Brokerage (self-directed online trading), where no human advisor involved and you are mostly managing investment on your own, a full-service brokerage offers a wide range of financial services, including investment advice, portfolio management, financial and estate planning, and insurance advice. If you think it sounds eerily similar to wealth management, you are not crazy. It is part of the wealth management puzzle, just without the Banking service piece.

What is Investment Counsel?

Investment counsel refers to professionals or firms providing personalized long-term investment advice and management. Usually with proprietary managed products, meaning if you use RBC PH&N Investment counsel service, then the investment products in your portfolio are mostly RBC managed mutuals funds or ETFs.

What is Asset Management?

You can think of asset management firms as manufactories of mutual funds and ETFs. Asset management involves managing investments to maximize returns while mitigating risks. Asset management firms like BlackRock and Vanguardmanage mutual funds, ETFs, along other investment products.

What is Capital Market?

Capital markets are venues where savings and investments are channeled between suppliers who have capital and those who need capital. In simple terms, it helps those who have the money find the people who need the money.

For example, BMO Capital Markets and RBC Capital Markets along with others helped the IPO (Initial Public Offering) of Definity Financial Corp. in 2021. In this case, it helped Definity Financial Corp. to raise money to grow, and helped investors a company to invest their savings and potentially earn returns.

Other than IPOs, other services Capital Markets provide including issuing Bonds, Mergers and Acquisitions of companies and foreign exchange etc.

Now, let’s have a look at the general business segments of the big six banks in Canada, and how they have intergraded the 4 pillars of financial industry under one umbrella.

Royal Bank of Canada (RBC)

RBC is the largest bank in Canada by market capitalization and assets. It is founded in 1864 in Halifax, Nova Scotia. Below is a brief fact list of RBC as of 2023:

Employee Count: Over 94,000 employees

Customer Base: 17 million

Revenue and Profits: Revenue of approximately $56.4 billion and net income around $14.9 billion.

Lines of Business:

o Personal and commercial banking

o Wealth management

- RBC Direct Investing is RBC’s Self-Directed online trading platform

- RBC InvestEase is RBC’s Robo-Advisor platform

- RBC Dominion Securities is RBC’s Full-Service brokerage

- RBC PH&N Investment Counsel is RBC’s Investment Counsel division

o Insurance

o Capital markets

RBC acquired City National Bank in 2015. As a result, City National Bank, now the retail banking subsidiary of RBC, operates about 70 branches across 10 states in the United States.

On March 28, 2024, the Royal Bank of Canada (RBC) completed its acquisition of HSBC Bank Canada for $13.5 billion. This deal was approved by the Canadian government on December 21, 2023, as part of HSBC's global restructuring efforts. The acquisition brings 4,500 employees and 780,000 clients from HSBC Canada into RBC, enhancing RBC’s international banking capabilities and expanding its presence in the Canadian market.

Toronto-Dominion Bank (TD)

TD, Toronto-Dominion Bank, is the second largest bank in Canada. It is established in 1955 from the merger of the Bank of Toronto (founded in 1855) and the Dominion Bank (founded in 1869). Below is a brief fact list of TD as of 2023:

Employee Count: Around 95,000 employees.

Customer base: 28 million globally

Revenue and Profits: Revenue of approximately $50 billion and net income around $10.8 billion as of 2023.

Lines of Business:

o Personal and commercial banking

o Wealth management

- TD Direct Investing is TD’s Self-Directed online trading platform

- TD Automated Investing is TD’s Robo-Advisor service

- TD Wealth Private Investment Advice is TD’s Full-Service brokerage

o Wholesale banking (Capital Markets)

Once, a couple from the U.S. was traveling in Toronto. As they strolled through the city, they passed by a TD Bank branch. One spouse nudged the other and said, "Look, honey, they have TD Bank here too!" – Sounds like they thought TD was a local U.S. bank. I wonder what they think TD stands for.

This little story goes to show that TD has a significant footprint in the U.S. through its subsidiary, TD Bank. This presence was established through the merger of TD Banknorth and Commerce Bank. Today, TD Bank operates nearly 1,177 branches and serves over 10 million customers across the United States.

Did you know? Canada's big banks are primarily owned by individual and institutional investors. For instance, as of May 2024, less than 1% of TD Bank's stocks were owned by its senior executives. The rest are held by mutual funds, public companies, institutional investors, and individual investors. This means that the $10.8 billion profit TD made in 2023 largely benefits its vast majority of shareholders.

Bank of Nova Scotia (Scotiabank)

Scotiabank is Canada’s third-largest bank in terms of total assets. It is founded in 1832 in Halifax, Nova Scotia. Below is a brief fact list of Scotiabank as of 2023:

Employee Count: Over 89,000 employees.

Customer Base: 23 million

Revenue and Profits: Revenue of approximately $32 billion and net income around $7.5 billion as of 2023.

Lines of Business:

o Canadian banking

o International banking

o Global wealth management

- Scotia iTrade is Scotia’s Self-Directed online trading platform

- Scotia Smart Investor is Scotia’s Robo-Advisor service

- ScotiaMcLeod is Scotia’s Full-Service brokerage

- MD Financial Management is a Wealth Management Division for physicians specifically

o Global banking and markets

Scotiabank has a travel itinerary that would make any globe-trotter jealous. Scotiabank has an international presence that spans over 15 countries. In addition to Canada and the U.S., Scotiabank is expanding its operations in Australia and already has an established presence in Europe and Asia. However, their main focus remains on Latin America, particularly the Pacific Alliance countries of Mexico, Chile, Peru, and Colombia, alongside Canada. They established this global footprint mainly through acquisitions, like the acquisition of R-G Premier Bank of Puerto Rico in 2010.

Bank of Montreal (BMO)

BMO is the fourth largest bank in Canada. It is founded in 1817 in Montreal, Quebec, making it the oldest bank in Canada. Below is a brief fact list of BMO as of 2023:

Employee Count: Over 53,000 employees.

Customers Base: 13 million

Revenue and Profits: Revenue of approximately $31 billion and net income around $4.4 billion as of 2023.

Lines of Business:

o Personal and commercial banking

o Wealth management

- BMO InvestorLine is BMO’s Self-Directed online trading platform

- BMO Smartfolio is BMO’s Robo-Advisor service

- BMO Nesbitt Burns is BMO’s Full-Service brokerage

o BMO Capital Markets

Did you know? Banks implement "firewalls" between their various business divisions to ensure regulatory compliance and uphold ethical standards. These internal policies and procedures are designed to prevent the sharing of non-public, sensitive information between departments, which could lead to conflicts of interest. For example, if BMO's capital markets division is helping your business with an initial public offering (IPO), they cannot share any insider information with your commercial banker to avoid insider trading or other conflicts. Similarly, your advisor at BMO Nesbitt Burns cannot access your bank account details, ensuring your financial information remains private, even though it might be more convenient if they could. This separation is crucial to prevent unfair competition and protect client confidentiality.

Canadian Imperial Bank of Commerce (CIBC)

CIBC is the fifth largest bank in Canada. It is formed in 1961 through the merger of the Canadian Bank of Commerce (founded in 1867) and the Imperial Bank of Canada (founded in 1875). Below is a brief fact list of CIBC as of 2023:

Employee Count: Around 48,000 employees.

Customer Base: 14 million

Revenue and Profits: Revenue of approximately $23 billion and net income around $5 billion.

Lines of Business:

o Personal and small business banking,

o Commercial banking

o Wealth management

- CIBC Investor's Edge is CIBC’s Self-Directed online trading platform

- CIBC currently does not offer Robo-Advisor service

- CIBC Wood Gundy is CIBC’s Full-Service brokerage

o Capital markets

Did you know? All chartered banks in Canada operate under the Bank Act, which is federal legislation setting out the rules and restrictions for banks. Due to these regulations, advisors on the banking side, including financial planners and private bankers, are not allowed to proactively provide specific insurance advice.

For example, a Financial Advisor in the personal banking division of CIBC cannot give specific insurance advice. However, a wealth advisor at CIBC Wood Gundy, the full-service brokerage side, can discuss insurance needs if necessary to protect your wealth and family.

This restriction is intended to promote fair competition among insurance providers, preventing banks from leveraging their extensive retail networks for an unfair advantage.

National Bank of Canada

National Bank is the sixth largest bank in Canada. It is founded in 1859 in Quebec City, Quebec. Below is a brief fact list of National Bank as of 2023:

Employee Count: Over 31,000 employees.

Customer Base: 2.8 million

Revenue and Profits: Revenue of approximately $10.2 billion and net income around $3.3 billion as of 2023.

Lines of Business:

o Personal and commercial banking

o Wealth management

- National Bank Direct Brokerage is National Bank’s Self-Directed online

trading platform

- National Bank currently does not offer Robo-Advisor service

- National Bank Financial Wealth Management is National Banks’s Full-

Service brokerage

o Financial markets.

On June 11, 2024, the National Bank of Canada announced a $5 billion agreement to acquire the Canadian Western Bank (CWB). The deal is expected to close by the end of 2025 and aims to boost National Bank's presence in Western Canada.

This merger will combine two complementary banks, enabling them to offer a wider range of services. The move is set to strengthen National Bank’s foothold in Western Canada, leveraging CWB’s customer relationships and market knowledge. Plus, it promises to protect jobs and maintain banking services in the regions both banks serve.

Conclusion

As you can see, all of the major banks have expanded their services beyond traditional banking, and incorporated Investment, Insurance and Trust as their holistic service package.

The Benefits

By offering a wide range of financial services under one umbrella, banks can provide convenience, efficiency, and expertise to their clients. Instead of dealing with multiple providers for banking, investment, trust, and insurance needs, clients can turn to one trusted institution for all their financial requirements. So, whether you need a mortgage, investment advice, estate planning, or insurance coverage, the modern financial landscape offers a one-stop shop for all your financial needs.